It’s a sweet deal if you’re the United Conservative Party or a corporation in Alberta: in return for relinquishing Alberta’s Heritage Fund and 33 per cent of corporate tax revenue, fiscal progressives finally get a PST.

In a recent opinion piece for the Calgary Herald, Danielle Smith made a half-hearted attempt to rally conservatives in support of a provincial sales tax – better known as a “Political Suicide Tax” here in Alberta.

“Alberta is a financial disgrace,” Smith declared.

“Calling the Alberta provincial budget a shambles doesn’t quite do justice to the utter state of chaos Ed Stelmach, Alison Redford, Rachel Notley and now, Jason Kenney have brought our finances to.”

Former premier Jim Prentice gets a pass; as before, apparently.

Danielle Smith plays the role of an independent libertarian conservative who “holds government to account” on her weekday morning radio show which airs on Calgary’s 1170 CHQR.

Much like 2014, when Smith abandoned her role as Leader of the Official Opposition and ran into the arms of Prentice’s governing Progressive Conservatives, she seems to still have more in common with the government than any who stand in opposition; leaving her attempt to create the “outrage du jour” feeling manufactured at best.

Smith offers a three-step plan that, despite blaming both current and successive premiers who were unlucky enough to govern without a natural gas boom, has more rainbows and unicorns than a Pride parade.

Step one is a gift to the UCP: drain the Heritage Fund of its total $17 billion and use it to pay down a portion of the projected $24 billion deficit for 2020-21 since, as Smith correctly notes, Alberta has “no plan to ever pay it off.” A keen insight without suggesting the government be accountable for the situation. Que Sera, Sera.

Jason Kenney’s carefully selected Blue Ribbon Panel, created to show Albertans they were simply paying more for services that none of the comparison provinces have, was given a mandate to look only at options to cut our way to prosperity but even they didn’t try to sell that as a reasonable path to balance.

Albertans love having premium-free healthcare and 70 per cent publicly-funded private schools, and fully subsidized separate schools; it’s the paying-for-it part that we have yet to fully appreciate.

Smith’s step three (we’ll get to step two in a moment) is to cut spending and increase taxes on Albertans in equal measure to fill a structural deficit of around $10 billion per year. In addition to offering up healthcare and education to shoulder $5 billion in cuts, she floats the prospect of a five per cent PST.

Heath and education have the largest line expenditures in Alberta’s budget at $21 billion and $8 billion, respectively.

“And let’s not kid ourselves about where the cuts need to be made,” she says without offering any additional information.

I think I can confidently say Smith would not suggest either the nationally unmatched subsidy for private education or the government’s recent decision to publicly fund more for-profit medical services are areas of spending concern for her.

The PST, as noted by Stephen Carter in a recent episode of The Strategists (wherever you get your podcasts), is something only a conservative government would be able to implement in Alberta.

Corey Hogan, slayer of unicorns and rainbows, also said during the same episode; “hope is not a plan.”

Which brings us to Danielle Smith’s second step, the brightest rainbow of them all: “establish the Alberta Sovereign Wealth Fund with a pledge (or a large piece of cardboard with the word “guarantee” emblazoned upon it?) to put every single dollar of resource revenue and every single dollar of investment income it generates… until – at a minimum – it reaches a value of $100 billion and can comfortably generate $5 billion a year in investment income.”

The $17 billion dollar fund currently generates about $1 billion each year, but starting from scratch would erase that.

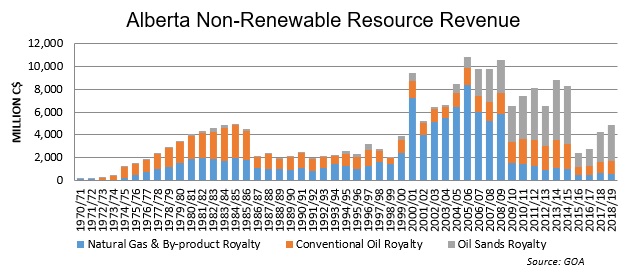

A quick look at the Alberta government’s numbers tells us that royalty revenues peaked at $11 billion over 50 years, mostly due to natural gas prices. Over the last ten years, royalty revenue averaged around $6.8 billion per year. During the last four it’s closer to $3.9 billion. Alberta would need around 15 years of $6.8 billion/year, or 20-some years at $3.9 billion to accumulate such a fund.

Since oil and gas companies stopped investing in new projects since 2020, however, royalty revenue has increased significantly, to the tune of an expected $14 billion dollar windfall for the province.

As Smith said during a recent leadership debate, that does mean the government is currently facing a structural operational deficit of almost $10 billion, thanks to our demand for the lowest taxes in the country.

Much like today, no “pledge”, or cardboard guarantee, exists to stop a subsequent government from cashing it in.

Smith may have been more credible had she taken Kenney’s government to task over his decision to fast-track the corporate income tax reduction by two years on June 30, 2020 – at a time when he surely knew 2020’s fiscal outlook.

Continuing to drop CIT rates each year after 2020, while increasing rates for Albertans, would have seemed mind-numbingly out of touch –harkens back to Prentice in 2015, in fact — and anyone who isn’t using their influence to support the UCP narrative would want us to think about that.

This post contains opinion and was updated on August 23, 2022 to add current information.

Deirdre Mitchell-MacLean is a political commentator physically distancing in Southern Alberta. Connect: @Mitchell_AB for more, @thisweekinAB for posts

Your support is greatly appreciated – sign up for a monthly contribution on Patreon or make a one-time donation to keep us going.

Categories: Opinion